Research Brief

Employment

April 2024

Immigration, Federal Aid Key Drivers

Behind March’s Strong Hiring

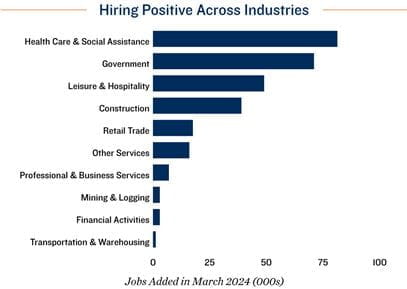

March logs the 39th straight month of job gains. Employment growth reached a 10-month high in March as 303,000 positions were added, while the unemployment rate adjusted down to 3.8 percent. Hiring was most prominent in health care, government, construction, and leisure and hospitality. Additions in health care and leisure and hospitality, in particular, should help ease staffing shortages in these sectors further. Immigration has also been a significant contributor to the stronger-than-expected labor market over the last year. This factor can be difficult to measure and predict, but the unemployment rate among foreign-born residents sank to 3.6 percent in March.

Office properties benefit from government hiring. Government roles accounted for nearly one-fourth of all jobs added last month as the sector hired 71,000. The segment’s employment growth surpassed its monthly average gain over the past 12 months by roughly 17,000 jobs, bolstered by hiring in the local government non-education segments. Working from home has become less prevalent in government roles, with the SWAA reporting that most of these employees work an average of just 1.3 days from home per week. The private sector still accounts for most of the nation’s office usage, but office space in metros like Washington, D.C., Sacramento and Norfolk-Virginia Beach, where government roles make up roughly 20 percent or more of the local workforce, could benefit the most from this trend. Stricter attendance policies and local and state agencies opting to lease space rather than own could also aid these assets.

Office properties benefit from government hiring. Government roles accounted for nearly one-fourth of all jobs added last month as the sector hired 71,000. The segment’s employment growth surpassed its monthly average gain over the past 12 months by roughly 17,000 jobs, bolstered by hiring in the local government non-education segments. Working from home has become less prevalent in government roles, with the SWAA reporting that most of these employees work an average of just 1.3 days from home per week. The private sector still accounts for most of the nation’s office usage, but office space in metros like Washington, D.C., Sacramento and Norfolk-Virginia Beach, where government roles make up roughly 20 percent or more of the local workforce, could benefit the most from this trend. Stricter attendance policies and local and state agencies opting to lease space rather than own could also aid these assets.

Restaurant operators welcome the reversal of pandemic job losses. The 49,000 new roles in March brought the total leisure and hospitality job count up to 16.9 million, just above the February 2020 benchmark. Restaurants and bars brought on 28,300 staff as consumers exhibit a willingness to eat out despite rising prices. These establishments registered a 1.8 percent increase in annual sales, even after factoring in inflation in the segment. This is positively impacting property performance as the retail sector exited 2023 with record-low vacancy of 4.5 percent. The metric is likely to stay low in the coming year as operators expand their businesses. Restaurant chains like Taco Bell, Shake Shack and Del Taco all opened dozens of locations last year and plan to carry that growth into 2024. Jack in the Box announced new locations outside of the franchise’s traditional western locations.

Federal policies enable the construction sector to pick up steam. Approximately 39,000 construction jobs were created in March, nearly double the average monthly gain over the prior 12 months. While construction activity has slowed in some industries as a result of higher interest rates, recent federal policies aimed at infrastructure appear to be spurring on builders in others. Specifically, hiring in the nonresidential specialty trade segment has been buoyed by continued CHIPS Act funding. Companies benefiting from this funding are not the only firms expanding their footprints. Suppliers and related businesses are also establishing a presence near these projects by building new spaces or taking up existing warehouses, distribution centers and manufacturing sites.

Positive inflation data should encourage interest rate cuts. Cyclical sectors like hospitality and construction have proven their resistance to higher borrowing costs, supporting the possibility of a soft landing result. While the Federal Reserve has not yet cut interest rates and persistently strong jobs numbers could lead to fewer cuts than initially anticipated, a lower range is expected by the end of 2024. In February, the personal consumption expenditures price index was just 50 basis points above the 2 percent target. Lowering inflation should warrant easing monetary policy, a boon for CRE investment. Buyer and seller pricing expectations have already begun to realign. Lenders will be further reassured by reduced interest rates and the 10-year Treasury staying in the low- to mid-4 percent range.

Federal Reserve; Moody’s Analytics; Real Capital Analytics; Survey of Working Arrangements and Attitudes (SWAA)

TO READ THE FULL ARTICLE